Fantastic Info About How To Buy Junk Bonds

Ishares iboxx high yield corporate bond etf (hyg) boasting net assets under management (aum) of over $21 billion, the ishares iboxx high yield corporate.

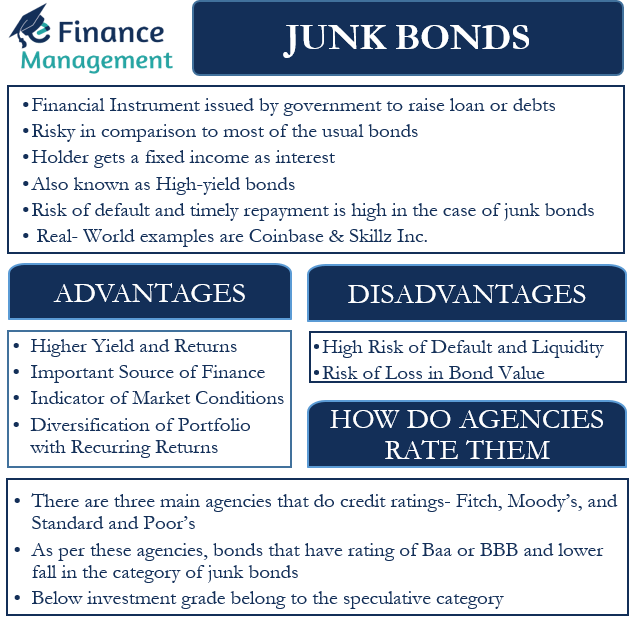

How to buy junk bonds. High yield bonds hold the potential for higher returns for two reasons. With cmc markets, it is possible to trade on junk bonds with a spread betting or cfd trading account. Buying into a junk bond mutual fund or etf (exchange.

Most brokerage firms’ bond desks will keep an inventory of already issued bonds for. Reputable how to buy junk bonds checklist check your junk bonds trading platforms broker has a history of at least 2 years. Most brokerage firms’ bond desks will keep an inventory of already issued bonds for.

Once you have identified your ideal brokerage platform, you can buy junk bonds in either of the following ways; How to buy junk bonds. You can also make money by reinvesting the money back into the company that issued the bonds.

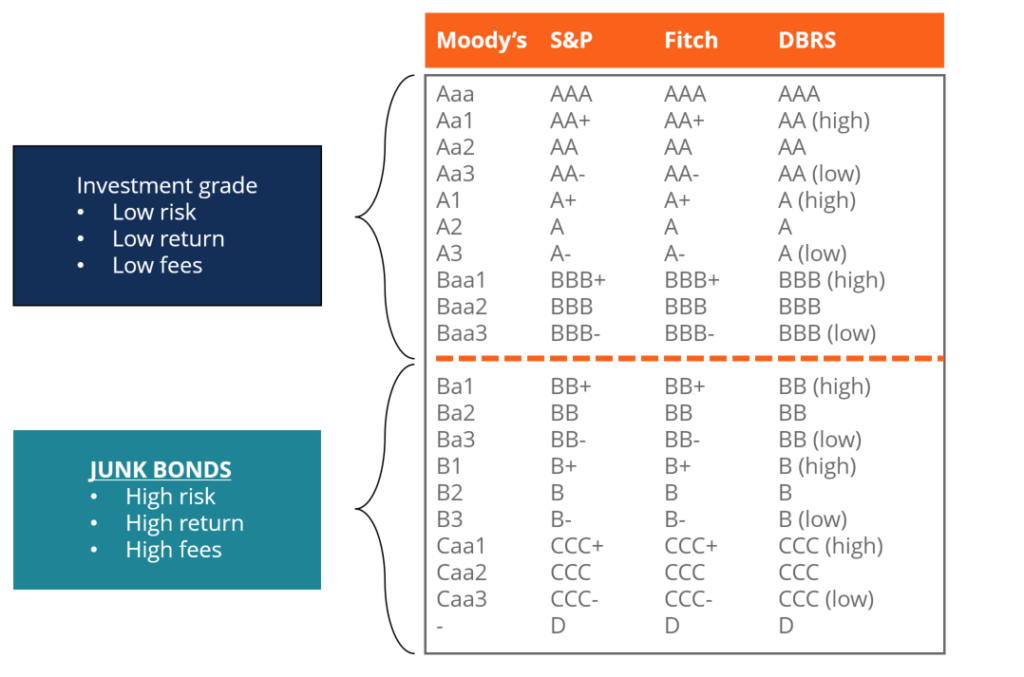

One year, two years and three years, for instance. You may be able to buy junk bonds through your online brokerage. Higher coupon rates in general the issuers of high yield bonds are considered less likely to make interest payments.

As each bond comes to. As an individual investor, there are a couple of different ways to buy junk bonds: Check your junk bonds trading platforms.

These are both derivative products that allow traders to speculate on the price. Junk bonds are generally brought to market by investment banks and sold through brokerage firms. Junk bonds are generally brought to market by investment banks and sold through brokerage firms.

/dotdash_Final_Everything_You_Need_to_Know_About_Junk_Bonds_Dec_2020-01-5306bf5871c8424bacc317dd8bef5c90.jpg)

/dotdash_Final_Everything_You_Need_to_Know_About_Junk_Bonds_Dec_2020-01-5306bf5871c8424bacc317dd8bef5c90.jpg)

/dotdash_Final_Everything_You_Need_to_Know_About_Junk_Bonds_Dec_2020-01-5306bf5871c8424bacc317dd8bef5c90.jpg)

![Junk Bonds Finally Capitulate To Lower Oil Price Environment [Chart] - Visual Capitalist](https://www.visualcapitalist.com/wp-content/uploads/2015/12/junk-bonds-oil-chart.png)