Matchless Info About How To Apply For Pst Number

How to apply online for pst and jest teaching jobs

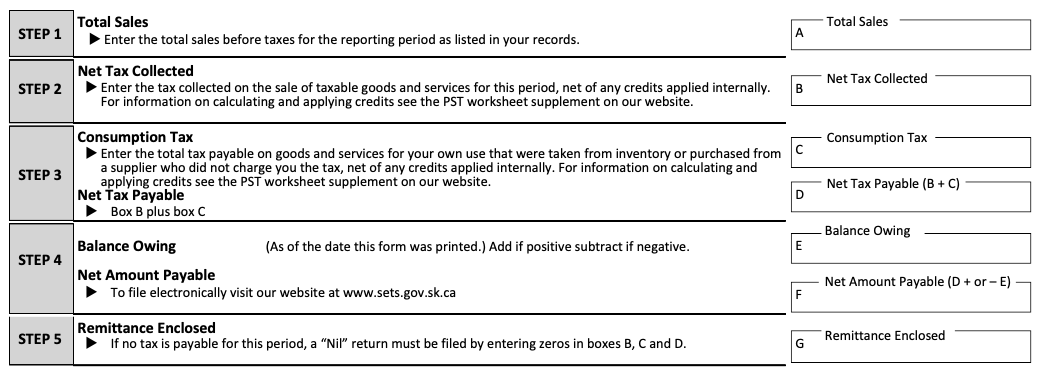

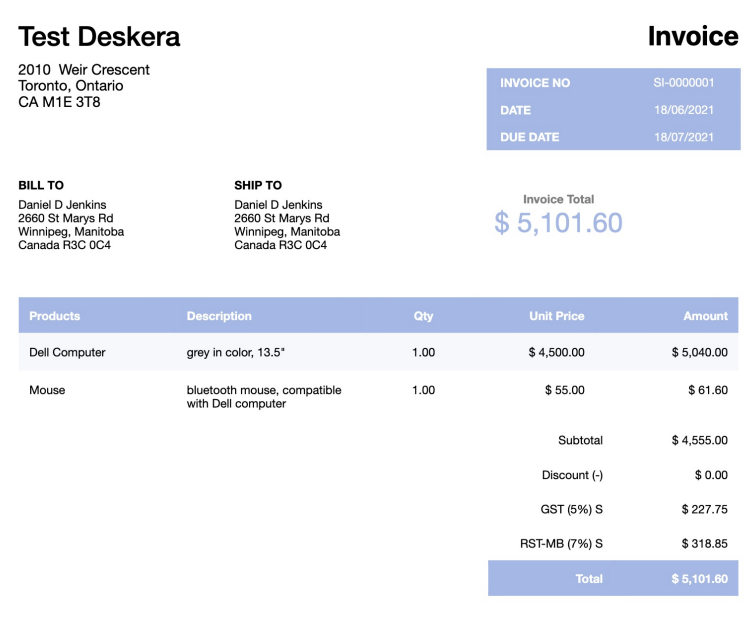

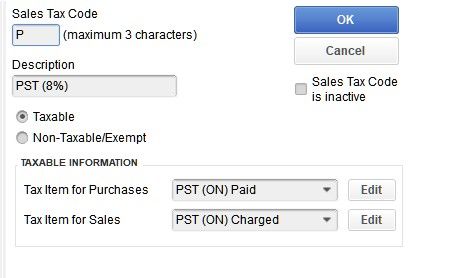

How to apply for pst number. The retail sales tax (rst or pst) is a tax applied to the retail sale or rental of most goods and certain services in manitoba. Apply for a provincial sales tax (pst) number overview businesses operating in saskatchewan must obtain a pst number for the purpose of collecting and remitting pst on sales of taxable. On receipt of your application, the consumer taxation branch will assign you a.

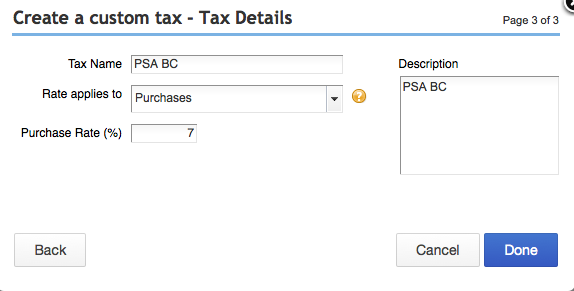

You have two options when registering for a pst number: For use in b.c., unless a specific. Option # 1 you can visit your local consumer taxation branch or government agents office and complete the.

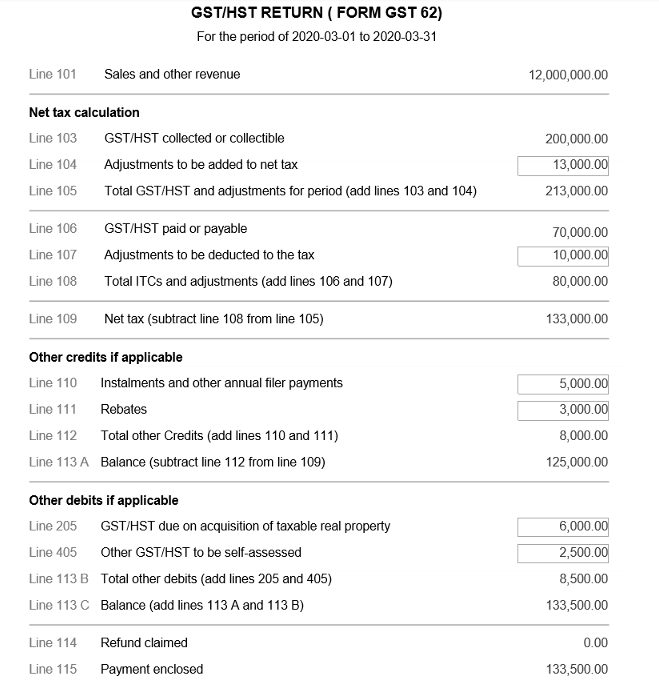

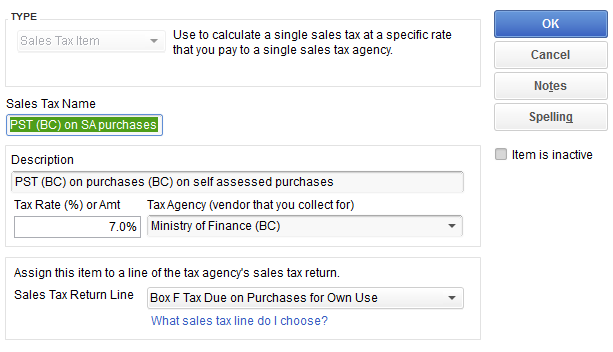

Bulk fuel acquisition and tax report. You can register to collect pst by completing the application for registration for provincial sales tax (pst) (fin 418) (pdf) and mailing or. Specifically, you must register for the gst and the qst if your total worldwide taxable supplies.

As a rule, you must apply for. Easy taxid fein number form. Due to the volume of refund applications received by the ministry, it may take up to 6 months to process a refund application once received by.

Register to collect pst through mail or fax. You may register for a gst/hst account if you make taxable sales, leases, or other supplies in canada. As a rule, you must register for the gst and qst if you carry on commercial activities in québec.

Provincial sales tax (pst) is a retail sales tax that applies when taxable goods or services are purchased, acquired or brought into b.c. The use of the bn simplifies business’ dealings with government by replacing the. You have two options when registering for pst number: