Underrated Ideas Of Tips About How To Protect Assets From Medicaid

Florida medicaid asset protection trusts are a viable planning strategy to meet medicaid’s asset limits when an individual has excess assets.

How to protect assets from medicaid. Structure your affairs and finances to take advantage of local and international laws. Ad protect your financial privacy. If the person you transfer assets to has any personal financial issues, like creditors or divorce, they could lose your property.

How to protect assets from medicaid. Giving away some assets may not always result in a penalty. We offer services for asset protection so you have assets to leave behind for your surviving spouse and other family members.

Some assets are exempt, but this. Here are a few ways you can protect your money and assets from medicaid: 5 ways to protect your money from medicaid 1.

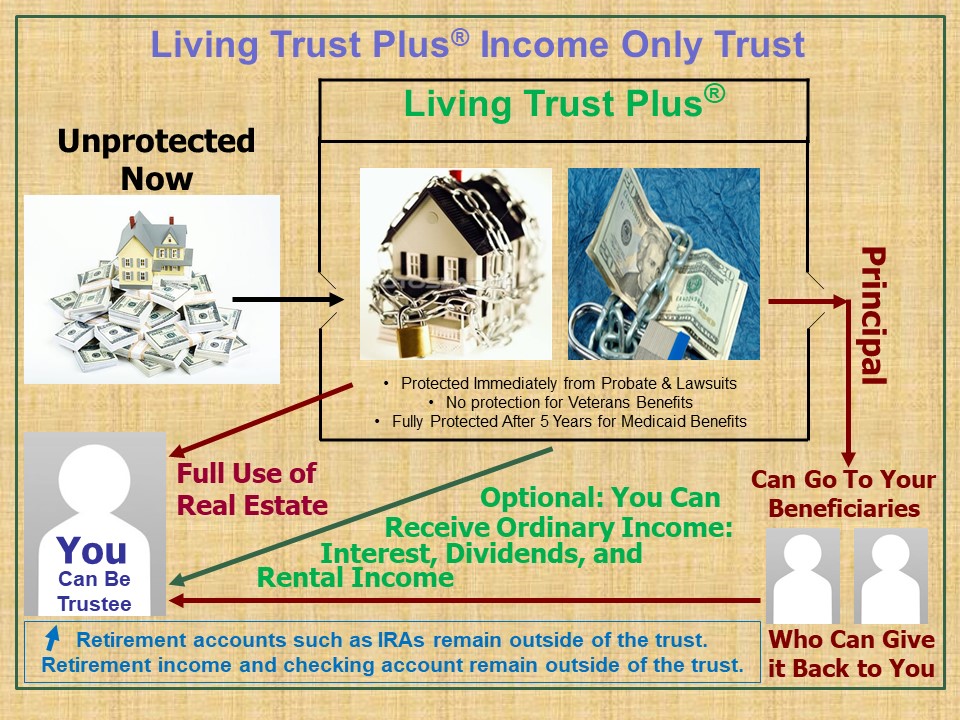

But, if designed correctly, this legal tool. An experienced elder law attorney can help you. As its name suggests, an asset protection trust is designed to protect one’s wealth.

By transferring the ownership of assets, a medicaid applicant’s spouse may receive the benefits of the program and continue to protect his or her assets from potential medicaid. The income and asset restrictions for medicaid are s. Income trusts income trusts serve the purpose of protecting your assets and keeping your monetary income safe.

An irrevocable trust can protect your assets against medicaid estate recovery. Strategies to preserve assets when applying for medicaid long term care half a loaf strategies. With this in mind, many people look for ways to protect their assets from medicaid, so they aren’t considered in the eligibility equation.