Here’s A Quick Way To Solve A Info About How To Handle Bill Collectors

These late or missed bill payments can begin the process of credit card delinquency — and over time, could.

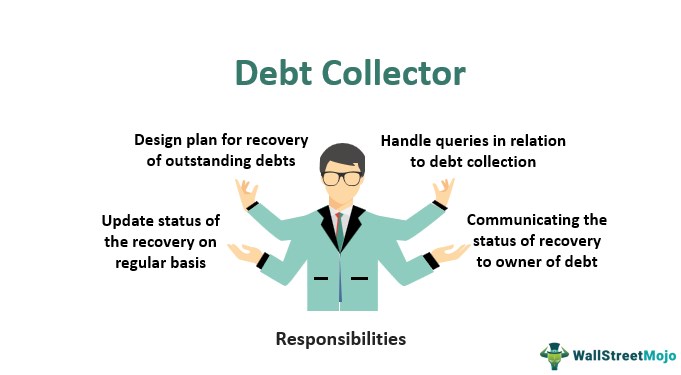

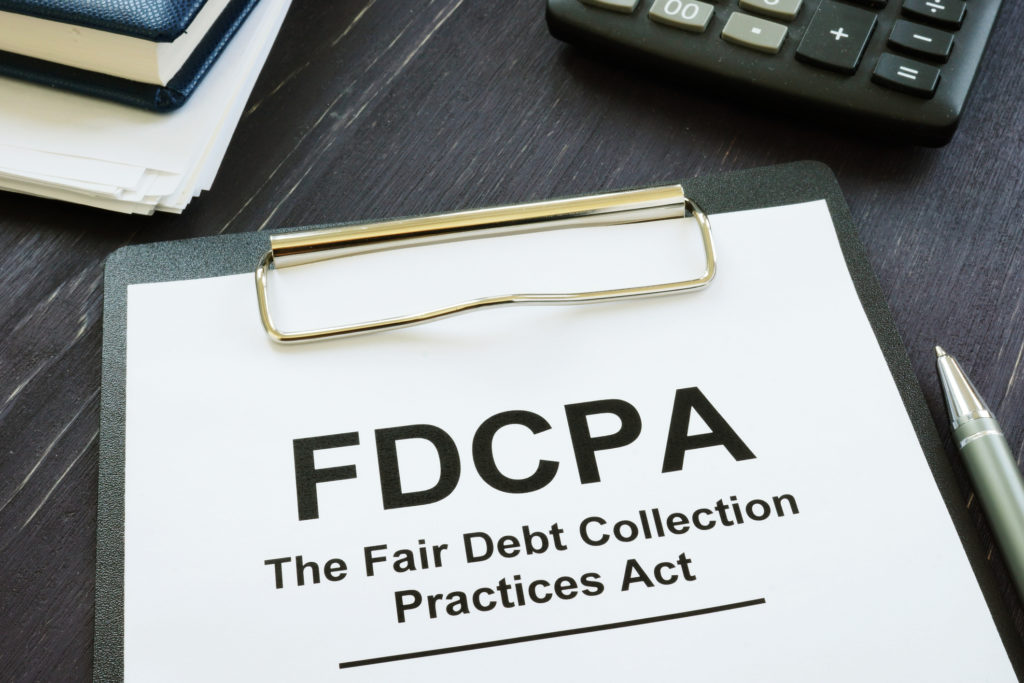

How to handle bill collectors. Write down the collection agency’s name and the amount they claim you owe and from what creditor. Most debt collectors follow the law when contacting you, but some do not. Keep an eye out for illegal contact from the debt collector.

Getty images.if you've ever dealt with a debt collector,. 22 minutes agoto help individuals regain control of debt collector calls, maliga shares five key actions to take: Here are 5 ways how to deal with debt collectors when you can’t pay and they keep calling.

Now that you understand your rights and how to watch out for potential scams, let's talk about how to deal with debt collector when they start ringing you up. How to handle bill collectors. Review the debt validation letter carefully and make sure the collector owns the debt.

If a debt collector continues to harass, lie or threaten you, it may be time to hire a lawyer for a small fee to send a certified letter asking them to stop contacting you. ask for written verification of the debt amount and additional. Write down the collection agency’s name and the amount they claim you owe and from what creditor.

Debt collectors will continue to contact you until a debt is paid. Many people are often so surprised and flustered, they say or do. Don’t be pressurized when debt collectors keep calling, sending letters, and.

This information can be important if the collector employs illegal. Check your records to make sure you. How to handle debt collectors apply for a personal loan today.